Table 1: Key Observations on HS-590390- Plastics-Coated Textile Fabrics and trade statistics for CY 2024

India leads the US nonwoven fabric market with a strong RCA of 20.85 and a competitive unit price of $2.21/kg.

Germany dominates premium segments at $12.07/kg, while China faces declining competitiveness due to US tariffs.

South Korea benefits from zero tariffs, boosting exports.

Rising demand in automotive, medical, and protective textiles will reshape global trade dynamics.

Source: TradeMap and F2F Analysis

Note: RCA – Revealed Comparative Advantage; UVR – Unit Value Realisation; LPI – Logistic Performance Index.

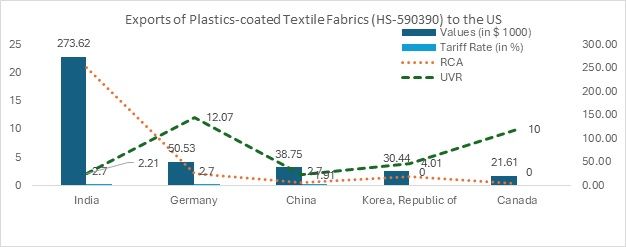

Figure 1: Key Exporters of plastics-coated textile fabrics to the US and trade statistics in CY 2024

India: The leader in the US market

India leads the US nonwoven fabric export market with an impressive export value of $273.62 million in 2024 and a strong RCA of 20.85, highlighting its competitive advantage. The average unit price of $2.21/kg reflects India’s ability to maintain cost-effective pricing while catering to the US demand amidst stiff competition.

Despite facing an applied tariff rate of 2.7 per cent, India continues to reinforce its market stronghold in the US, driven by high production capacity, competitive labour costs, and an efficient supply chain.

With a Logistics Performance Index (LPI) of 3.4, India demonstrates above-average trade efficiency, further strengthening its position. Given its high RCA, cost advantage, and logistical capabilities, India is well-positioned to expand its market share and emerge as a key winner in this category.

Germany: Premium market segment in the US

Germany, with an export value of $50.53 million in 2024, has established a strong foothold in the nonwoven fabric market, especially in the US, supported by an RCA of 2.15. Its significantly higher unit price of $12.07/kg reflects a focus on premium-quality, specialised industrial applications, such as automotive, medical, and high-performance technical textiles.

The 2.7 per cent tariff rate has a minimal impact on Germany’s exports, as the country primarily caters to high-value niche markets where quality and innovation outweigh cost considerations. This strategic positioning enables Germany to maintain its competitive edge despite tariff barriers.

China: Cost-competitive player

China’s nonwoven fabric exports stood at $38.75 million in 2024, but an RCA of 0.58 signals declining competitiveness in the US market compared to its key challengers.

With a low unit price of $1.91/kg, China continues to focus on high-volume, cost-efficient exports. However, sustaining this model in the face of rising global competition and shifting trade dynamics remains uncertain.

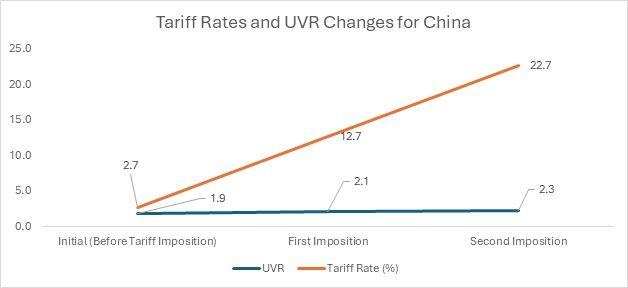

Tariff Impact: With the first tariff imposition on February 4th, 2025, the tariff rate increased to 12.7 per cent. This rise in the tariff burden would lead to an increase in the UVR as production and export costs escalate. As a result, the UVR would likely increase to around $2.1/kg, reflecting the growing challenges posed by the higher tariffs. The increase in the UVR shows that the products are becoming more expensive, which could make them less competitive for price-sensitive consumers.

In the second tariff imposition, effective from March 4th, 2025, the tariff rate rose further to 22.7 per cent. This substantial increase would push the UVR to approximately $2.3/kg or higher. The higher tariff burden will continue to raise costs, further diminishing the cost-effectiveness of the products. However, India could significantly benefit from this tariff imposition on China, as Chinese plastic-coated textile fabrics might turn out to be more expensive than the Indian ones.

South Korea: Zero-tariff advantage

South Korea exported $30.44 million of plastics-coated textile fabrics in 2024, positioning itself as a strong player in the US in this segment. With a unit price of $4.01/kg, South Korea sits between India and China on the lower end and Germany and Canada on the higher end, balancing cost-effectiveness with quality.

A zero per cent tariff rate under the KORUS Free Trade Agreement (FTA) provides a significant competitive advantage in the US market, enabling South Korea to access key markets with reduced trade barriers and enhanced export potential.

Canada: A niche exporter with limited competitiveness

Canada, with an export value of $21.61 million in 2024, holds an RCA of 0.36, indicating low competitiveness in the market despite several strategic advantages. As a nation bordering to the US, Canada benefits from lower shipping costs and free trade access under existing agreements.

However, its limited market share suggests that it primarily caters to high-value, niche segments rather than mass exports. The average unit price of $10.00/kg reinforces this, reflecting a focus on specialised, premium-quality textile products rather than high-volume trade.

Market overview & strategic outlook

China’s reliance on high-volume, cost-competitive exports is under pressure due to a 2.7 per cent tariff plus an additional 10 per cent, weakening its market position and creating opportunities for competitors. In contrast, Germany, with its focus on premium, high-value textiles, is well-positioned to expand its market share. South Korea benefits from zero tariffs under select FTAs, enhancing its price competitiveness in key markets. India, while holding a strong market position, should focus on improving quality and expanding into high-value segments to strengthen its foothold.

Germany and Canada can sustain their premium pricing by investing in R&D and innovation, ensuring continued demand for high-performance textiles. South Korea’s strategic advantage lies in leveraging FTAs and zero tariffs to drive export growth.

As China’s market position declines, competitors stand to gain, reshaping trade dynamics in the US. The rising demand in automotive, medical, and protective textiles will be a key driver of growth, while sustainability trends will push the industry towards eco-friendly coated textiles. The evolving trade policies of the Trump administration will play a crucial role in reshaping global supply chains and influencing market dynamics.

Fibre2Fashion News Desk (NS)