This post may contain affiliate links and Corporette® may earn commissions for purchases made through links in this post. As an Amazon Associate, I earn from qualifying purchases.

In the current U.S. financial fiasco of tariffs, layoffs, a tight job market, big 401(k) losses, inflation, and economic unpredictability in general, we thought it’d be the perfect time to round up some of the best tools for managing your budget. If you’ve been hanging in there and just want to get more organized about your spending and saving, or you need to refigure your big picture because of a major life change *raises hand*, check these out!

We’ve previously rounded up the best financial books for beginners, but today we’re sharing books and apps that focus on learning how to budget. Please share your favorite resources and tools in the comments!

Not all of the books below are recently published, though general budgeting tips don’t change too much from year to year. If you’re solely looking for guidance regarding the dumpster fire Americans are facing, read this article from The WSJ [gift link] on making wise money decisions, and this Washington Post story [gift link] about changing your shopping habits.

{related: tales from the wallet: how to make a budget}

{related: not sure what to do first/next in your personal finance journey? here’s our money roadmap}

The Best tools for Managing Your Budget: BOOKS

You Need a Budget

You Need a Budget: The Proven System for Breaking the Paycheck-to-Paycheck Cycle, Getting Out of Debt, and Living the Life You Want by Jesse Mecham (2017)

[Amazon / Bookshop]

Fans of the iconic YNAB tool — and Corporette readers in general! — won’t be surprised that we’re including this book, because it’s a classic. If you’re a newbie to budgeting or just never have been too organized with spending and saving, this book’s strategies will help you streamline things.

Mecham, who created his personal finance company and the YNAB tool before writing this book, wrote it to help readers change their relationship to money and reduce financial stress. He provides four straightforward rules here: (1) Give Every Dollar A Job, (2) Embrace Your True Expenses, (3) Roll With The Punches, and (4) Age Your Money.

Read more about the associated YNAB tool, a reader-favorite system, below!

The One Week Budget

The One Week Budget: Learn to Create Your Money Management System in 7 Days or Less! by Tiffany Aliche, “The Budgetnista” (2011)

[Amazon / Bookshop]

If you don’t have a ton of time to focus on (and agonize over) budgeting, or to read a super comprehensive personal finance book, The One Week Budget by The Budgetnista is a smart pick.

The One Week Budget is a brief, basic guide that explains how to carefully budget by tracking every penny, and it includes with simple forms and helpful examples. It’s suitable for adults but also is written with a teenage audience in mind — and it shows Aliche’s sense of humor.

This book could be perfect for new grads and those who are starting their first career job. (We also rounded up our top financial tips for women just starting high salary jobs.) Do note that reviewers say it may realistically take longer than the “one week” due to allowing enough time to collect data on your spending habits.

Aliche has also written other financial books (including one for kids), appeared in a Netflix basic guide to personal finance and PBS special, “Get Good With Money“; writes a blog; and runs an online course.

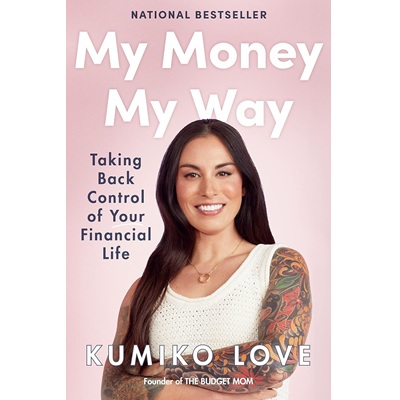

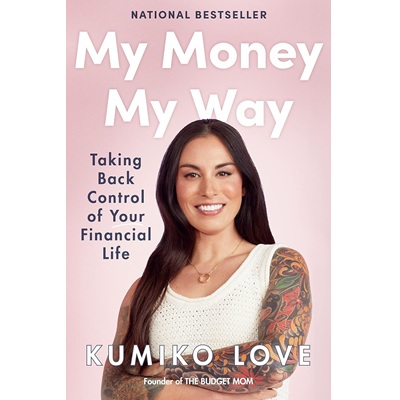

My Money My Way

My Money My Way: Taking Back Control of Your Financial Life by Kumiko Love (2022)

[Amazon / Bookshop]

Kumiko Love, the author of My Money My Way, is the creator of The Budget Mom (offering podcast, budgeting system, courses, and so on), but this book is aimed at all women, whether or not they’re moms. Her financial street cred: Love paid off $78,000 in debt and was able to buy a house in cash. She’s also an accredited financial counselor.

You know, if a personal finance expert appears on the cover of her book with full sleeves (no shade, I am tattooed myself!), it’s a good sign her writing won’t be staid and dry. That impression pans out here, as Love’s summary emphasizes “align[ing] your emotional health with your financial health.” It can be hard to separate emotions from finances sometimes, after all. *sigh*

Love’s is meant to help readers understand their spending habits, make good decisions, and create a budget. Your purchase comes with a reading guide, six video lessons, and a “financial fulfillment checklist,” all on The Budget Mom website.

{related: the best personal finance resources from professionals}

The Best Apps for Managing Your Budget

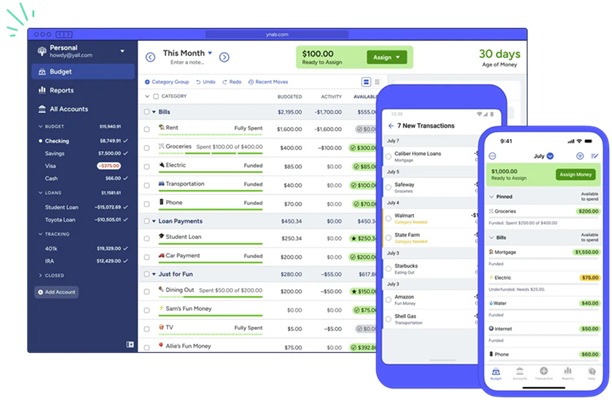

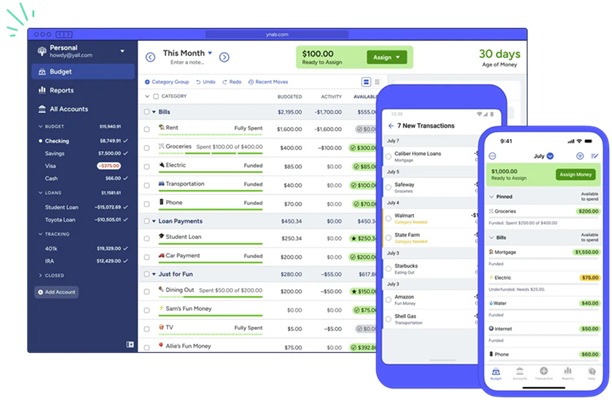

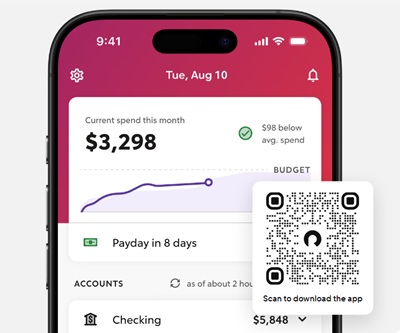

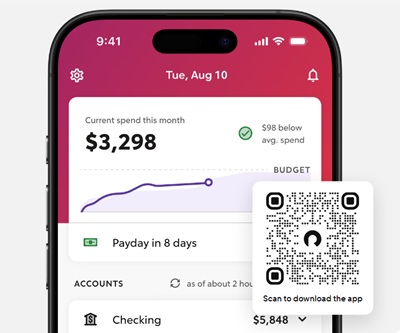

You Need a Budget

YNAB is a hugely popular personal finance tracking tool, and lots of readers are big fans. Its website promises to teach users to “give every dollar a job,” “fund your wildest dreams,” “define priorities and guide spending decisions toward the life you want,” and “life spendfully.” (Does the word “spendfully” bother anyone else? Eh, I won’t hold it against the app.)

In addition to the basic features you’d expect in a money app, here are a few others to know about: all-device syncing, community challenges, goal tracking, key reports, debt management help, and the ability to share your subscription with others. Online, YNAB also offers free Q&As, workshops, a blog, and an online community.

YNAB has a free 34-day trial (the site doesn’t ask for your credit card first), and after that, the fees are $109/year (comes out to $9.08/month) or a $14.99/month plan. Here’s a guide to starting out with the app.

{related: 3 great online personal finance classes}

Rocket Money

I’ve been hearing good things about Rocket Money lately (and no, not just in their podcast ads!) It has a couple of features YNAB doesn’t have, especially regarding bills and the unneeded subscription services many of us have. (I mean, am I really reading enough Scientific American to keeping paying my online subscription? I am not.)

Rocket Money lists your subscriptions in one place, and your “concierge” can even cancel them for you (nice!). It also enables you to track your spending and net worth and to keep tabs on and lower your bills, with the aim of saving more and spending less. It also guides your saving habits to reach your goals, has handy phone widgets, gives you a free credit score, and even negotiates bills for you (for a fee, of course). Its website has free personal finance guides for members and non-members, and the company also offers a credit card.)

While Rocket Money is free, a premium membership with extra features is available for $6-$12/month, and you can sign up for a free 7-day trial (not nearly as long as YNAB’s!)

{related: money challenge: review your renewing subscriptions}

FINAL NOTES on budgeting!

- I recently used Quicken Simplifi for a little while (RIP Mint), and I don’t feel like it gives you anything special compared to the two tools above. (YMMV, because Wirecutter once called it the best budgeting app.) It costs $5.99 a month, but I paid $38 for one year back in January during a sale.

- You can read more detailed info, and opinions on budgeting systems on Reddit, plus general advice. Start with out r/personalfinance, r/financialplanning, and r/budget. Some of the personal finance subreddits contain helpful wikis, too.

- If you’re looking for budget spreadsheets and don’t want to reinvent the wheel, check Etsy if you don’t mind paying for a fancy one. I just bought this template from Etsy because it was $5, but now it’s marked $26 on sale (?!). (It also turned out to be more complicated than I expected.) Microsoft 365 has a selection of free budget templates to try, and you can even ask a finance-savvy friend if they have one to share. (I did this and got a good, simple one.)

Readers, we’d love to hear your budgeting tips and fave tools and books! Also, does anyone out there still keep track of things on PAPER, either using your own system or free online printables? I’m kind of tempted.

Stock photo via Stencil.