President Donald Trump’s recent decision to impose, effective April 10, a sweeping 125 per cent tariff on Chinese textile and apparel imports—compared to a mere 10 per cent duty on comparable goods from all other countries—has severely undermined China’s price competitiveness in the US market. This enormous tariff disparity makes Chinese products vastly more expensive than those of other suppliers, effectively pricing many Chinese goods out of contention. US importers are expected to respond by shifting orders to alternative sourcing markets to avoid the exorbitant costs, especially favouring suppliers in low-cost manufacturing countries with well-established trade ties to the United States.

The imposition of a 125 per cent US tariff on Chinese apparel significantly undermines China’s pricing advantage, causing importers to seek alternative sources.

Countries like Vietnam, Bangladesh, and Indonesia stand to gain notably across multiple apparel categories.

This trade shift presents substantial opportunities for nations with robust apparel manufacturing sectors and established trade with US.

Figure 1

Source: TexPro

In 2024, the United States imported apparel worth $72.99 billion from its top 15 exporting partners, accounting for approximately 87.2 per cent of its total apparel imports. China remained the leading exporter with $18.39 billion, representing 22 per cent of the market share, followed closely by Vietnam at $15.33 billion (18 per cent) and Bangladesh at $7.40 billion (9 per cent). India ranked fourth with $4.93 billion (6 per cent), showcasing its growing influence in the global apparel trade. Other significant contributors included Indonesia, Cambodia, and several Central American nations, reflecting the diversified sourcing strategy of the US apparel industry.

Impact on apparel products

Fibre2Fashion examines the potential impact on key apparel categories—such as jerseys, trousers, hosiery, and undergarments—among China’s top exports to the US. The imposition of steep tariffs on these products is likely to significantly drive up the cost of Chinese goods in the US market, undermining one of China’s main competitive advantages: low pricing. As China grapples with this substantial setback, countries with lower tariff exposure (around 10 per cent), robust manufacturing capabilities, and well-established trade relationships with the US are well positioned to gain from the resulting shift in sourcing strategies.

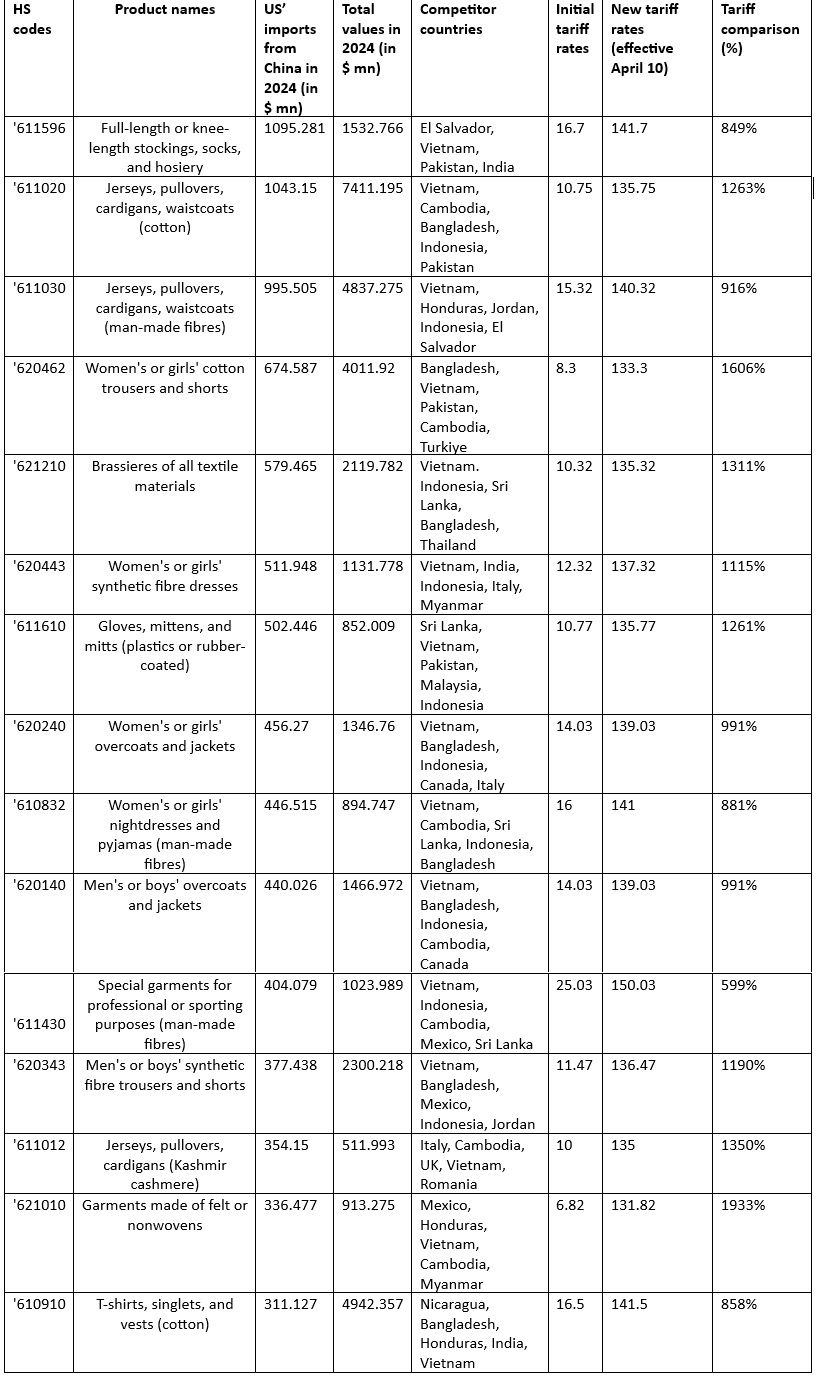

Table 1: US’ top 15 apparel imports (6-digit HS code) from China, total export values, competitors, initial and new tariff rates and tariff comparison in %

Source: TexPro

The recent imposition of substantial tariffs by the United States on Chinese textile and apparel imports has significantly altered global trade dynamics, particularly affecting China’s competitiveness in the US market. This shift presents opportunities for other manufacturing countries to capture increased market share across various product categories. Below is an analysis of the impact on specific apparel segments:

1. Hosiery (HS 611596)

- 2024 US Import Data: Total imports were valued at $1,532.77 million, with China contributing $1,095.28 million.

- Tariff Impact: An 849 per cent tariff increase on Chinese hosiery has made these products considerably more expensive.

- Beneficiary Countries: Vietnam, Pakistan, and El Salvador are poised to benefit. Vietnam, with its robust hosiery manufacturing infrastructure and competitive pricing, is particularly well positioned to capture a larger market share.

2. Cotton Pullovers and Cardigans (HS 611020)

- 2024 US Import Data: Total imports stood at $7,411.20 million, with China accounting for $1,043.15 million.

- Tariff Impact: A 1,263 per cent tariff increase on Chinese imports creates opportunities for other suppliers.

- Beneficiary Countries: Vietnam, Cambodia, and Bangladesh are likely to gain. Vietnam’s established cotton garment industry positions it to capture a significant share, while Cambodia and Bangladesh offer cost advantages that appeal to US buyers.

3. Man-Made Fibre Pullovers (HS 611030)

- 2024 US Import Data: Imports totalled $4,837.28 million, with China contributing $995.51 million.

- Tariff Impact: A 916 per cent tariff increase on Chinese products affects sourcing decisions.

- Beneficiary Countries: Vietnam, Honduras, and Indonesia stand to benefit. Vietnam’s strong synthetic garment manufacturing base makes it a primary alternative, while Honduras and El Salvador can also attract buyers seeking competitive pricing.

4. Women’s Cotton Trousers and Shorts (HS 620462)

- 2024 US Import Data: Total imports were $4,011.92 million, with China supplying $674.59 million.

- Tariff Impact: A 1,606 per cent tariff increase on Chinese goods shifts demand.

- Beneficiary Countries: Bangladesh, Vietnam, and Pakistan are well positioned. Bangladesh’s low-cost manufacturing is particularly attractive, while Vietnam’s advanced production capabilities also make it a strong contender.

5. Brassieres (HS 621210)

- 2024 US Import Data: Imports amounted to $2,119.78 million, with China providing $579.47 million.

- Tariff Impact: A 1,311 per cent tariff hike on Chinese brassieres alters market dynamics.

- Beneficiary Countries: Vietnam, Indonesia, and Sri Lanka are set to gain. Vietnam, already a leader in undergarments, is expected to see the most significant increase in demand, with Indonesia and Sri Lanka also capturing portions of the market.

6. Synthetic Fibre Dresses (HS 620443)

- 2024 US Import Data: Total imports were $1,131.78 million, with China accounting for $511.95 million.

- Tariff Impact: A 1,115 per cent tariff increase on Chinese dresses impacts sourcing.

- Beneficiary Countries: Vietnam, India, and Indonesia are likely to benefit. Vietnam’s strong position in synthetic apparel makes it the prime beneficiary, while India and Indonesia offer competitive pricing that appeals to US importers.

7. Gloves and Mittens (HS 611610)

- 2024 US Import Data: Imports totalled $852.01 million, with China supplying $502.45 million.

- Tariff Impact: A 1,261 per cent tariff hike on Chinese gloves and mittens affects cost structures.

- Beneficiary Countries: Sri Lanka, Vietnam, and Pakistan stand to gain. Sri Lanka’s specialised focus on glove manufacturing positions it to see the greatest increase in demand, while Vietnam and Pakistan offer efficient manufacturing processes that attract buyers.

8. Women’s Overcoats (HS 620240)

- 2024 US Import Data: Total imports were $1,346.76 million, with China contributing $456.27 million.

- Tariff Impact: A 991 per cent tariff increase on Chinese overcoats shifts sourcing preferences.

- Beneficiary Countries: Vietnam, Bangladesh, and Indonesia are well positioned. Vietnam’s strong garment export sector is expected to dominate, while Bangladesh and Indonesia can capture market share due to their competitive prices.

9. Nightdresses and Pyjamas (HS 610832)

- 2024 US Import Data: Imports amounted to $894.75 million, with China providing $446.52 million.

- Tariff Impact: An 881 per cent tariff hike on Chinese products influences market dynamics.

- Beneficiary Countries: Vietnam, Cambodia, and Sri Lanka are poised to benefit. Vietnam’s dominant position in sleepwear makes it the primary beneficiary, with Cambodia and Sri Lanka also positioned to capture additional demand.

10. Men’s Overcoats (HS 620140)

- 2024 US Import Data: Total imports were valued at $1,466.97 million, with China supplying $440.03 million.

- Tariff Impact: A 991 per cent tariff increase on Chinese men’s overcoats affects sourcing strategies.

- Beneficiary Countries: Vietnam, Bangladesh, and Indonesia stand to gain. Vietnam is poised to capture a significant share due to its established export network, while Bangladesh and Indonesia offer competitive alternatives.

11. Sporting Apparel (HS 611430)

- 2024 US Import Data: The United States imported sporting apparel valued at approximately $1.02 billion, with China supplying about $404 million.

- Tariff Impact: The US has imposed a 599 per cent tariff increase on Chinese sporting apparel, significantly raising the cost of these imports.

- Potential Beneficiaries: Vietnam, Indonesia, and Cambodia are positioned to benefit from this development. Vietnam, with its efficient manufacturing capabilities and robust apparel sector, stands to gain the most. Indonesia and Cambodia may also capture market share in specific niches within the sporting apparel segment.

12. Men’s Synthetic Trousers (HS 620343)

- 2024 US Import Data: The US imported men’s synthetic trousers worth approximately $2.3 billion in 2024, with China accounting for around $377 million.

- Tariff Impact: A 1,190 per cent tariff increase on Chinese imports in this category has been implemented.

- Potential Beneficiaries: Bangladesh, Vietnam, and Indonesia are likely to benefit. Bangladesh, with its large-scale production capacity, is well positioned to capture a significant portion of the market. Vietnam and Indonesia also stand to gain due to their established manufacturing infrastructures and competitive pricing.

13. Luxury Cashmere Garments (HS 611012)

- 2024 US Import Data: Luxury cashmere garment imports to the US were valued at approximately $512 million, with China supplying about $354 million.

- Tariff Impact: The US has imposed a 1,350 per cent tariff hike on Chinese luxury cashmere products.

- Potential Beneficiaries: Italy, Vietnam, and other European manufacturers are set to benefit. Italy, renowned for its luxury textiles and craftsmanship, is likely to see the most significant gain. Vietnam may also benefit from increased demand for mid-range cashmere products, leveraging its growing expertise in garment manufacturing.

14. Felt and Nonwoven Garments (HS 621010)

- 2024 US Import Data: The US imported felt and nonwoven garments valued at approximately $913 million in 2024, with China contributing around $336 million.

- Tariff Impact: A 1,933 per cent tariff increase on Chinese imports in this category has been enacted.

- Potential Beneficiaries: Mexico, Honduras, and Vietnam are well positioned to absorb the shift in sourcing. Mexico, with its proximity to the US and favourable trade agreements, stands to gain significantly. Vietnam and Honduras can also benefit due to their established garment industries and competitive production costs.

15. Cotton T-Shirts and Vests (HS 610910)

- 2024 US Import Data: In 2024, US imports of cotton T-shirts and vests totalled approximately $4.94 billion, with China supplying about $311 million.

- Tariff Impact: An 858 per cent tariff increase on Chinese products in this category has been imposed.

- Potential Beneficiaries: Vietnam, Bangladesh, and Honduras are poised to benefit. Vietnam, with its efficient supply chains and competitive pricing, is the key beneficiary. Bangladesh and Honduras are also expected to capture additional market share due to their cost-effective manufacturing capabilities and established export relationships with the US.

These tariff adjustments are prompting US importers to diversify their sourcing strategies, leading to a realignment of global supply chains in the textile and apparel industry. Countries with competitive manufacturing sectors and favourable trade relations with the US are well positioned to capitalise on these changes.

Fibre2Fashion News Desk (NS)